Across all industries, artificial intelligence and machine learning techniques are commonly used to improve processes and leverage data, saving time and money. But, is your firm using them to support operational risk management?

While Chief Risk Officers at financial institutions back in 2017 stated that advanced analytics are "a potential game changer", we are yet to see them being used widely in operational risk.

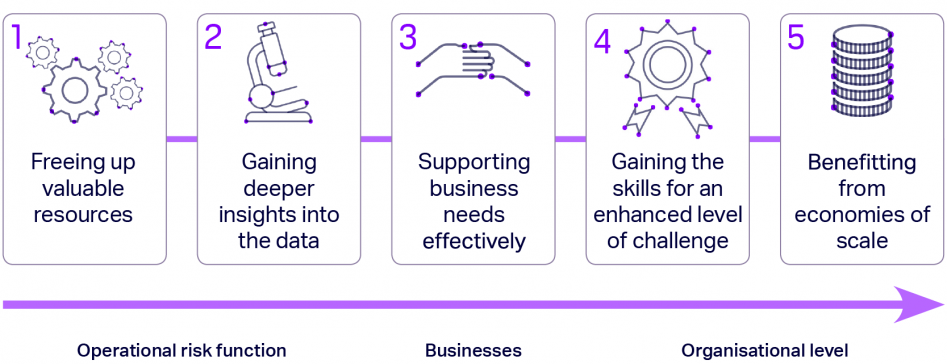

At ORX, we believe that machine learning and AI will be a vital element of future strategies for operational and non-financial risk management. So, we created a working group of operational risk professionals from our member firms to specifically explore how these techniques can be used in operational risk. Our recently published white paper identified five key ways that organisations could benefit from using machine learning techniques.

Five opportunities for using machine learning in op risk management

1. Freeing up valuable resources

Potentially, the biggest gains from the implementation of machine learning can be expected to come from the reduction or elimination of time-intensive and repetitive tasks. These tasks take up valuable time of operational risk teams are often related to the collection, handling and analysis of operational risk data. As such, they are well suited to robotic process automation.

2. Gaining deeper insights into data

Operational risk teams usually have a large amount of data at their fingertips. This includes decades-worth of loss event data which often contains free-text descriptions. These fields could contain huge amounts of useful information, but are, as yet, untapped.

Reviewing this dataset would be too time-consuming to be economically viable, but this is where machine learning techniques come in. Text mining could be used to get deeper insights into this information – for example, looking at root causes and risk drivers. We've recently begun a research study focusing on this specific area of application.

3. Supporting business needs

Operational risk needs to be able to provide easily consumable information if we're going to effectively support the front line in day-to-day business activities. Gaining deeper insights into the existing data not only helps operational risk functions, but also supports the front line in their operational risk management activities.

4. Gaining the skills for an enhanced level of challenge

As the use of machine learning and AI increases, so will regulatory focus. Operational risk professionals will need the skills and knowledge to be able to challenge the use of these techniques within the business.

5. Benefitting from economies of scale

The use of machine learning techniques for operational risk can also benefit the whole firm. Where these techniques are used to improve existing preventative controls, such as fraud detection, considerable gains can be made even from incremental increases in predictive accuracy. Moreover, reducing the time needed for mundane tasks, such as loss data entry and categorisation, will benefit not just operational risk functions, but also first-line staff.

Read the machine learning white paper to find out more

You can read more about how operational risk can benefit from using machine learning techniques in the free white paper, Machine learning in operational risk: Making a business case for its practical implementation. Read the report to find out how machine learning, AI and advanced analytics could impact the industry.